What Am I Invested In Again?

It's important to understand what you're invested in and how it relates to your risk tolerance. We walk our clients through every step of the investment process so they feel comfortable about what they have.

Managed Portfolios Tailored to You

We invest our clients money in diversified managed portfolios, meaning, we are always actively watching your money and diversifying your portfolio across different market sectors (not having all your eggs in one basket!). Each portfolio is tailored to your specific risk tolerance and overall goal for your account.

We believe in investing for the long-run, never trying to "time" the markets.

We believe in investing for the long-run, never trying to "time" the markets.

|

Flex Portfolios

We call our in-house managed portfolios "Flex Portfolios" because of the flexibility they have to be designed for your personal objectives while remaining adaptive to market conditions. Built on quantitative analysis and fundamental research, our portfolios are managed by our very own CIO, Chris Zaccarelli, CFA who is frequently seen on CNBC, along with our internal investment committee.

Vertical Divider

|

Robo Solution

For those looking for a tech-friendly, easy-to-use investment platform, we have partnered with

"Betterment" to provide clients with a Robo-Advisor solution. Clients get a streamlined investment platform while leveraging the financial advice through us. |

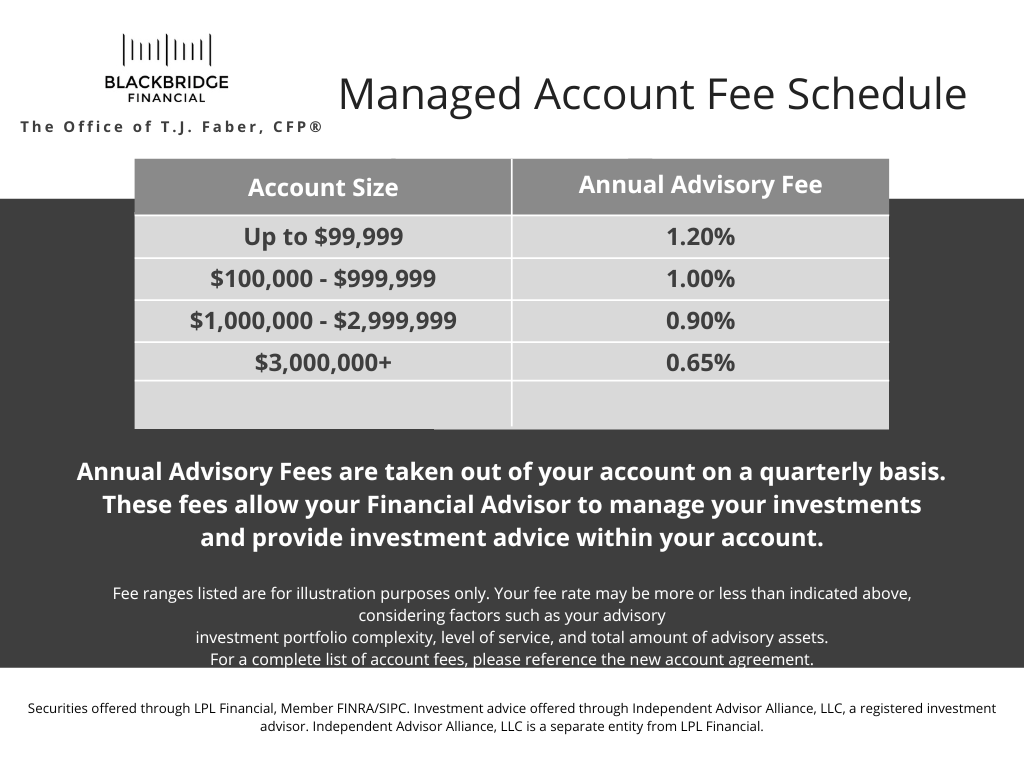

No Commissions, No Trading Fees

Yes, you read that correctly! The only fee our clients pay is an annual advisory fee. It's an annual % of the total account balance, paid quarterly from the account. There are no up front commissions or trading fees when we place a trade. This allows us to make as many changes needed in your account without costing you, the client, any additional fees.

With an advisory fee, it aligns the incentives of both the advisor and the client. Because the advisor gets paid by a % of the account value, the advisor does well when you do, and feels the same pain you do when your account goes down.

The Investment process

1. Initial meetingFree 30-minute initial conversation to learn more about you and explain the investment process

|

2. INVESTMENT OBJECTIVES60-minute meeting to determine what your comfort level of risk is and what goals you have for the portfolio

|

3. Portfolio Presentation60-minute meeting to go over your investment portfolio in-depth, discussing % of stocks and bonds used and how you can expect the portfolio to do in different market conditions.

|

4. ReviewOn an on-going basis, we will sit down to review how your portfolio has been performing and discuss any changes we have made.

|

Pricing