What Keeps You Up at Night?

While we understand how important it is for you to achieve your financial goals, we also understand there is only so much time in a day. While your busy taking care of others and trying to manage a million things at once, who's looking out for you and your financial future? That's what we're here for.

|

What is Financial Planning Anyways?

Financial planning, in the simplest term, is creating a plan that answers questions like:

It's taking a look at everything you have from a 30,000ft view and bringing it altogether in one complete picture. Think of it as taking a big bankers box (yes they still exist!) and dumping in all your account statements, past years tax returns, insurance policies, work benefits, mortgage statements, "EVERYTHING!" and letting us sort through it all.

Doing so allows us to discover exactly where you are today, where you want to be in the future and develop a plan together on how to get there. Think of us as your Financial Coach, helping you pursue your goals, while being by your side every step of the way.

|

Vertical Divider

What We Can Help With

Ready to Take Control of Your Finances?

Are Your Goals on Track?

|

The planning process

1. IntroductoryFree 30-minute initial conversation to learn more about you and explain the planning process

|

2. Getting Organized60-minute meeting to help organize everything you have, dive deeper into the numbers, your goals and what you want to accomplish

|

3. Where you're going60-minute meeting to go over your financial plan with easy-to-understand recommendations on how to pursue your goals

|

4. implementation30-minute follow up meeting to help make sure the recommendations are being implemented

|

5. MonitorMonitor the plan and adjust with life changes to make sure everything is up-to-date

|

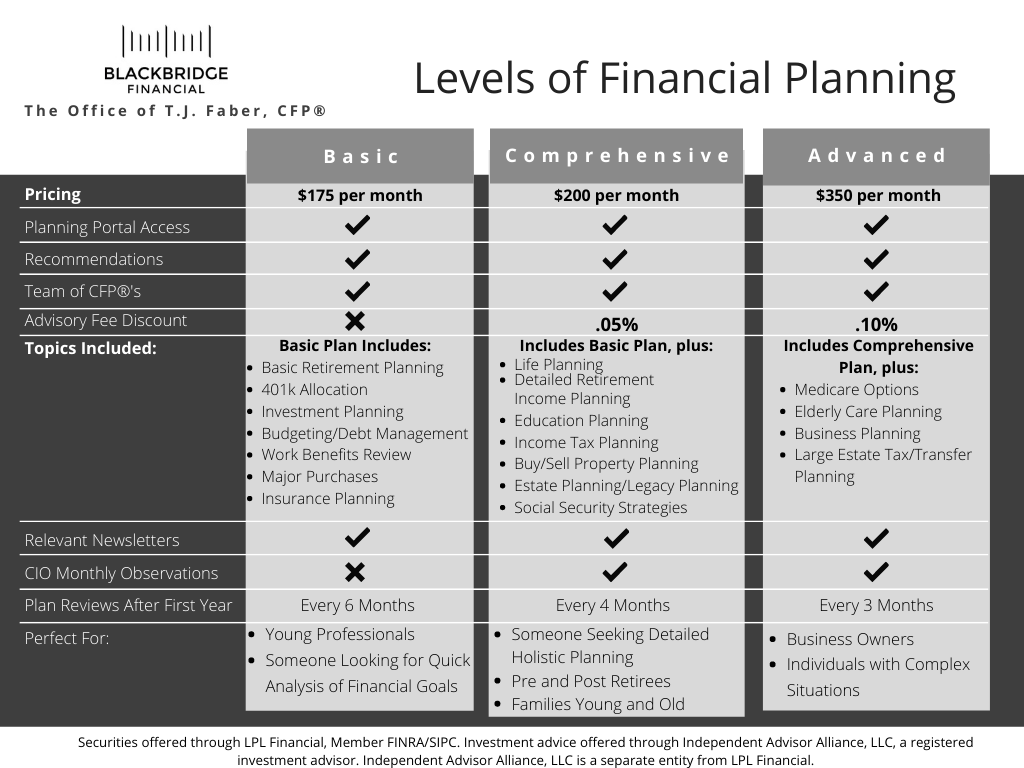

Pricing

Don't Need On-going Financial Planning Advice?

We offer Financial Plans and Project-Based plans for a one-time fee.

We offer Financial Plans and Project-Based plans for a one-time fee.

As a financial planning client, we will set you up with your very own Planning Portal where you can monitor and track your goals, all in one place. This way, your financial plan is always at the palm of your hand, no matter where you are. In your website, you also have access to the "Vault" where you can safely store all you're important documents like passports and tax returns, with unlimited storage space.